US Tariffs are creating a Deadweight Loss

Deadweight Loss in Vehicle Manufacturing: A Breakdown

Tariffs, taxes, and price controls can create deadweight loss, leading to inefficiencies in supply and demand. In the short term, this distorts market dynamics, but over time, it impacts efficiency, innovation, and global competitiveness.

The U.S. Auto Market in 2024

In 2024, approximately 16 million new vehicles were registered in the U.S. at an average price of $48,000. However, domestic manufacturers produced only 10 million vehicles, meaning the remaining 6 million were imported.

The Impact of Tariffs

Let’s assume:

All U.S.-manufactured vehicles are entirely built domestically and subject to no tariffs.

All imported vehicles face a 25% tariff.

Manufacturers and dealers pass 100% of the tariff cost onto consumers.

With these assumptions, the average price of a new vehicle rises to $52,500. While this generates tariff revenue, it reduces both consumer and producer surplus and creates deadweight loss—vehicles that would have been sold at a lower price but are now priced out of the market. In reality, most vehicles have a foreign component that will lead to even higher prices.

Broader Consequences:

U.S. consumers, already struggling with record-high auto loan delinquencies, face further financial strain.

Higher prices contribute to inflation and make refinancing more expensive.

Consumers delay purchases, reducing overall demand and increasing demand and prices for used vehicles.

Short-Term vs. Long-Term Effects

In the short term, there may be announcements of increased domestic production. However, the reality is that expanding production in a limited market is inefficient—U.S. vehicles remain costly, and demand shrinks as foreign cars become more expensive.

We've already seen tactics like predatory pricing and stockpiling, but excess inventory won’t last. In the medium term, vehicles will cost more to produce and maintain. In the long run, U.S. automakers may struggle to compete globally, as their cars become more expensive and less advanced. If tariffs persist, the U.S. risks being left behind, producing inefficient gas-powered vehicles while the rest of the world moves toward better, cheaper, and more efficient hybrids and EVs.

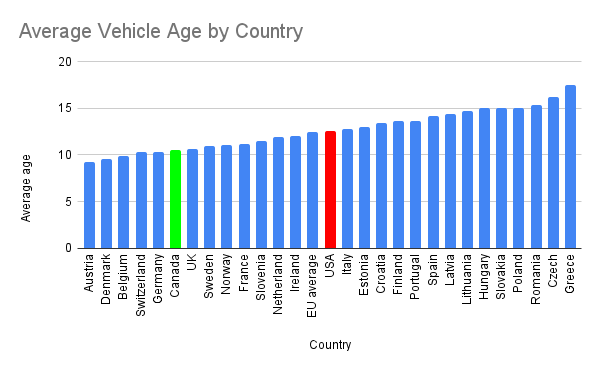

A Different Approach for Canada

Canada should remove 100% tariffs on Chinese EVs, and should leverage its existing production capacity to manufacture vehicles tailored to its unique needs. Our poor road conditions and harsh winters require either greater investment in infrastructure or the development of vehicles designed specifically for our climate. A forward-thinking approach would allow Canada to stay competitive in the evolving automotive industry.